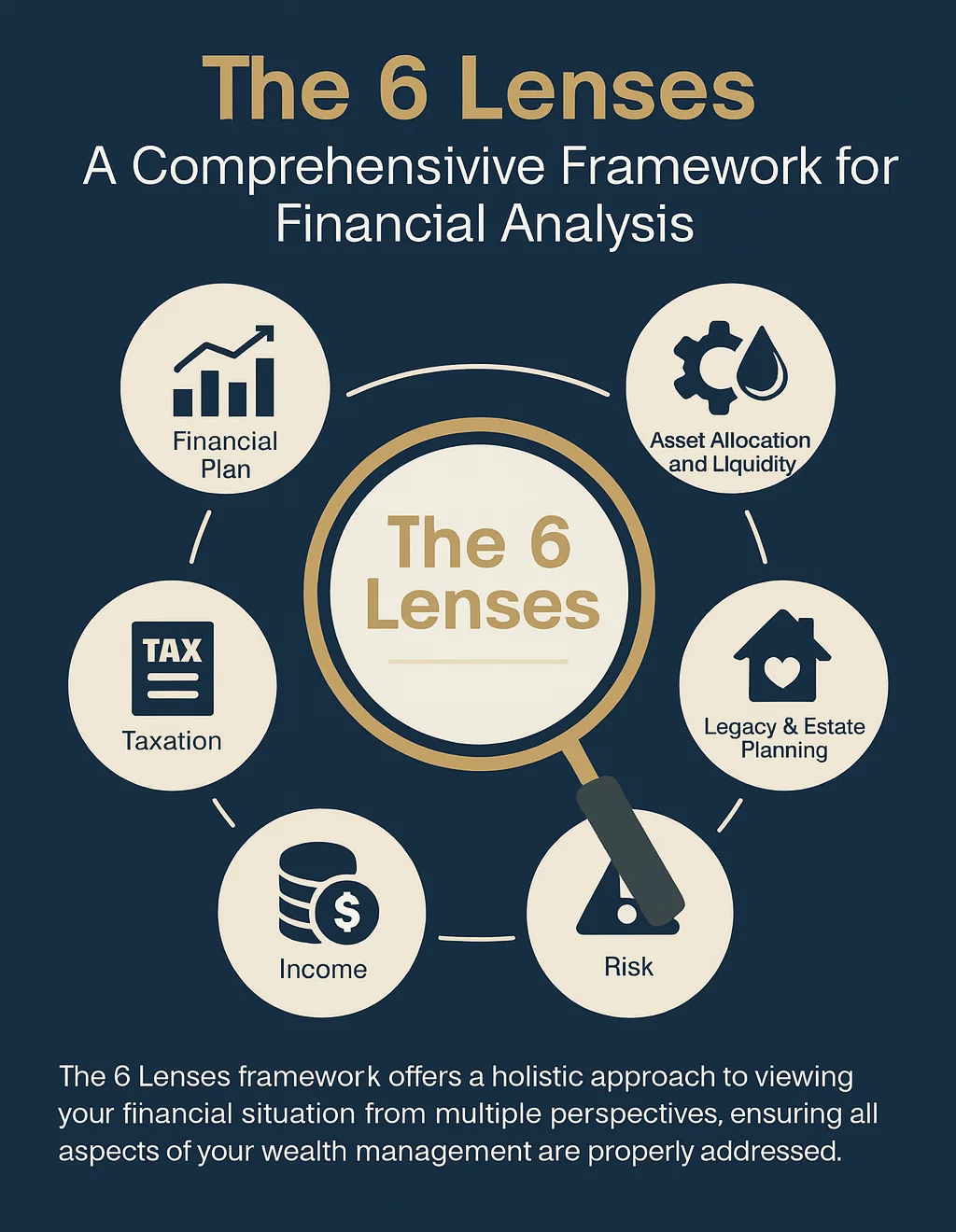

The 6 Lenses: A Comprehensive Framework for Financial Analysis

The 6 Lenses Framework offers a holistic approach to viewing your financial situation from multiple perspectives, ensuring all aspects of your wealth management are properly addressed. This structured methodology, developed by financial advisors, helps identify strengths and potential gaps in your financial plan.

1. Financial Plan

This lens examines the foundation of your financial strategy by asking:

- What rate of return is necessary for your financial plan to succeed?

- Does Monte Carlo analysis (which simulates thousands of possible market scenarios) show a 90%+ probability of success?

- Is the necessary portfolio structure aligned with your personal risk tolerance?

2. Asset Allocation and Liquidity

This perspective evaluates your investment structure:

- Is your current portfolio allocation appropriate for your needs and the market environment?

- Do you have sufficient liquid assets for immediate needs?

- Are you taking advantage of the potential higher returns from illiquid investments like private equity or real estate?

- Does your overall allocation match your comfort with risk?

3. Taxation

This lens focuses on tax efficiency across your accounts:

- How is your portfolio distributed among taxable, tax-deferred, and tax-free accounts?

- What strategies could improve your overall tax efficiency?

- Are you maximizing tax-advantaged opportunities?

4. Income

This perspective evaluates your reliable income sources:

- Do you have sufficient predictable income from sources like interest, dividends, pensions, and annuities?

- What is your PIC (Predictable Income Coverage) ratio compared to your expenses?

- Is your income strategy sustainable for your lifetime?

5. Legacy and Estate Planning

This lens looks beyond your lifetime to wealth transfer:

- Have you taken steps to minimize or eliminate potential estate taxes?

- Are all legal agreements signed and accounts properly titled?

- Are charitable and family gifts structured in the most tax-efficient manner?

- Does your estate plan reflect your wishes and values?

6. Risk

The final lens examines various types of risk:

- Market risk: Portfolio volatility and investment downturns

- Longevity risk: Outliving your assets

- Inflation risk: Loss of purchasing power over time

- Credit risk: Default by borrowers

- Interest rate risk: Value fluctuations due to changing rates

- Health risk: Medical costs and care needs

- Currency risk: Exchange rate fluctuations

- Concentrated stock risk: Overexposure to single investments

- Legal risk: Liability and litigation concerns

By viewing your finances through these six distinct lenses, advisors can create a more comprehensive financial strategy that addresses both opportunities and vulnerabilities across multiple dimensions of your financial life.

The Capitol Bay Group, a financial advisory practice of LPL Financial, utilizes this framework to provide clients with thorough financial guidance tailored to their specific needs and goals.

For informational purposes only. Specific financial advice should be obtained from a qualified financial professional.